Simply Wall Street: A Game-Changer for Investors

If you’re like me, you’ve probably spent hours poring over financial reports, spreadsheets, and news articles trying to decide which stocks to buy. It was overwhelming. Analyzing dozens of companies, comparing their financials, and trying to get a sense of their future prospects—it felt like an endless maze. But everything changed when I found Simply Wall Street.

Simply Wall Street has completely transformed how I approach investing. It’s like having a personal finance assistant at my fingertips, helping me analyze and evaluate stocks with ease. No more sifting through complex data. Everything is simplified, and I can quickly see the big picture. The platform offers a user-friendly interface that makes stock analysis accessible to everyone, whether you’re a seasoned investor or just starting out.

The Benefits for You

What makes Simply Wall Street stand out? Let me tell you:

- Clear and Simple Stock Analysis

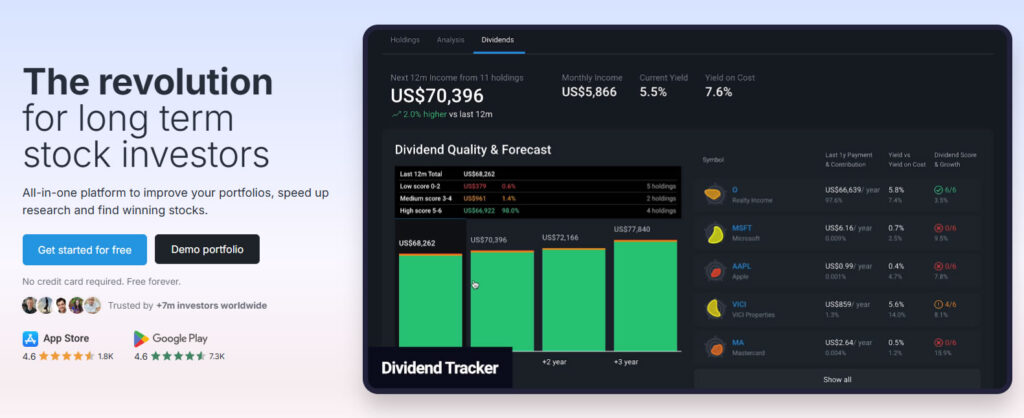

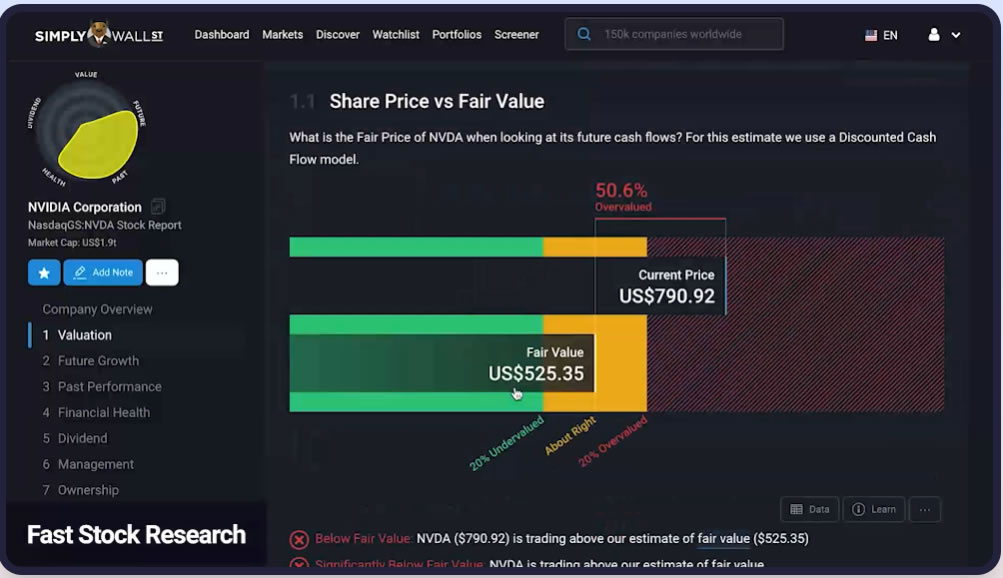

Simply Wall Street breaks down complex financial data into easy-to-understand visuals. With color-coded charts, infographics, and summaries, you can quickly grasp a company’s financial health. It’s like getting a snapshot of a company’s performance, growth prospects, and valuation—all in one place. - Tailored Investment Insights

Simply Wall Street allows you to filter and analyze companies based on specific criteria. Whether you’re looking for stocks with a low P/E ratio, strong growth potential, or a high dividend yield, you can customize your search to fit your investing strategy. The platform even offers “investment themes” to help you focus on industries or sectors you’re interested in. - Cost-Effective

Compared to hiring a financial advisor or spending hours doing research on your own, Simply Wall Street is incredibly affordable. For the value it provides, the subscription fee is very reasonable, especially when you consider the time and effort it saves. It’s one of the best investments you can make as an investor.

How It Works: Filters and Results

One of the best features of Simply Wall Street is its filters. You can narrow down stocks based on a variety of criteria, such as:

- Valuation: Search for stocks that are undervalued or overvalued.

- Dividend Yield: Find companies with the best dividend payouts.

- Growth: Filter for companies that have strong growth prospects.

- Risk: Identify stocks with low or high levels of risk based on their financials.

Once you set your filters, Simply Wall Street provides a rating for each stock. This rating is based on a comprehensive analysis of the company’s financials, industry trends, and other key factors. It makes decision-making so much easier and takes the guesswork out of investing.

——————————————————————————————————

Disclaimer

Do More Money is not a financial advisory service.

All content is for informational purposes only.

This is not financial advice.

We collect and share public insights from major investors and third-party sources.

We do not offer personalized advice and we are not financial advisors.

All information remains the property of its respective authors or original sources