Same story every month: the paycheck comes in, and after two weeks, the money is gone.

Then you spend days counting coins, waiting for the next payday.

The problem isn’t always how much you earn, but how you manage what you have.

One simple way to avoid running out of money is to split the month into weeks and set a spending limit for each one.

In this post, I’ll show you how to create a weekly budget that helps you stay on track, save more, and stress less.

“Do not save what is left after spending, but spend what is left after saving.”

– Warren Buffett

The idea is simple: instead of managing your money monthly, break it down into 4 weeks.

If you earn €1,200 a month, for example, you can set a max spending limit of €300 per week.

And from that €300, subtract your fixed costs (like rent, bills, subscriptions).

Quick example:

- Income: €1,200

- Fixed expenses: €600

- Leftover: €600

- Weekly budget: €150

This way, you know exactly how much you can spend each week, and you won’t run out halfway through the month.

You can track this with physical envelopes or use an app.

A common mistake is thinking “I’ve got plenty of money” at the beginning of the month.

So you overspend on dinners, shopping, and extras.

Then mid-month, you start cutting back hard.

With a weekly budget, you spread your spending evenly, avoid waste, and reduce the anxiety of having nothing left later on.

Some people also find it helpful to make a priority list: what’s essential and what can wait?

So the budget becomes a tool for better choices, not a restriction.

Conclusion with Key Takeaways

A weekly budget changes everything.

It helps you stay aware, avoid pointless spending, and live more calmly.

You don’t need to be a finance expert: just paper, a pen (or an app), and a bit of focus.

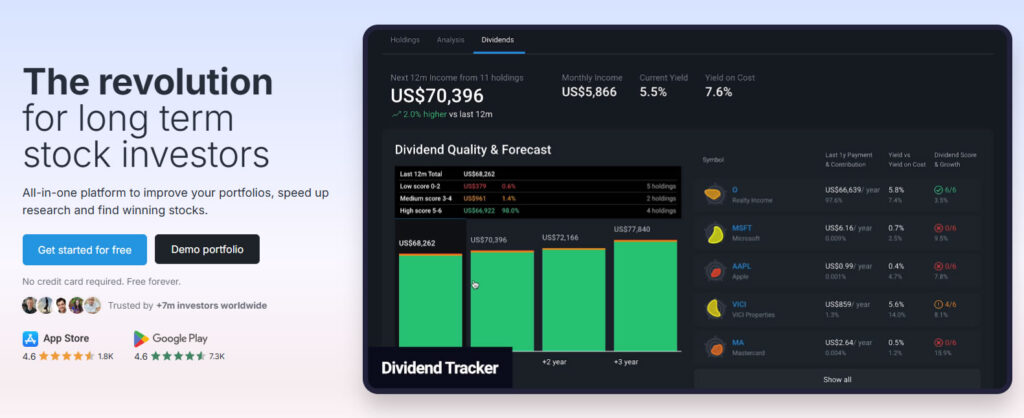

Here are 3 easy-to-use apps to help:

- Goodbudget – Uses the envelope method, visual and simple.

- Spendee – Lets you set weekly budgets and view spending charts.

- Monefy – Minimalist, quick to use, great for fast expense tracking.

Try it for just one week. You’ll notice the difference immediately.

_______________________________________________________________________

Disclaimer

Do More Money is not a financial advisory service.

All content is for informational purposes only.

This is not financial advice.We collect and share public insights from major investors and third-party sources. We do not offer personalized advice and we are not financial advisors. All information remains the property of its respective authors or original sources

Leave a Reply